Accounting software on cloud – Cloud accounting software has emerged as a transformative solution for businesses, offering unprecedented convenience, efficiency, and insights into their financial operations. By leveraging the power of the cloud, businesses can now access their accounting data and tools from anywhere, anytime, and on any device.

This cutting-edge technology streamlines accounting processes, automates tasks, and provides real-time visibility into financial performance, empowering businesses to make informed decisions and drive growth.

Cloud-Based Accounting Software Overview

Cloud-based accounting software is a type of accounting software that is hosted on the internet, rather than on a local computer. This means that you can access your accounting data from anywhere with an internet connection, and you don’t have to worry about installing or maintaining the software yourself.

There are many benefits to using cloud-based accounting software. Some of the most notable benefits include:

- Increased accessibility:You can access your accounting data from anywhere with an internet connection, which makes it easy to work on your finances from home, the office, or even on the go.

- Reduced costs:Cloud-based accounting software is often more affordable than traditional accounting software, as you don’t have to pay for hardware or software installation and maintenance.

- Improved security:Cloud-based accounting software providers typically have robust security measures in place to protect your data from unauthorized access.

- Automatic updates:Cloud-based accounting software is automatically updated, so you don’t have to worry about keeping up with the latest changes to tax laws or accounting standards.

Some of the most popular cloud-based accounting software providers include:

- QuickBooks Online

- Xero

- NetSuite

- Sage Intacct

- FreshBooks

Cloud-based accounting software typically offers a wide range of features and functionalities, including:

- Invoicing and billing:Create and send invoices, track payments, and manage customer accounts.

- Expense tracking:Track expenses, categorize them, and generate expense reports.

- Financial reporting:Generate financial reports, such as balance sheets, income statements, and cash flow statements.

- Payroll:Manage payroll, including calculating payroll taxes and issuing paychecks.

- Inventory management:Track inventory levels, create purchase orders, and manage vendors.

Cloud-based accounting software can be a great way to improve the efficiency and accuracy of your accounting processes. If you’re looking for a way to streamline your finances, cloud-based accounting software is definitely worth considering.

Read more: Unveiling the Power of Oracle Accounting Software: A Comprehensive Guide

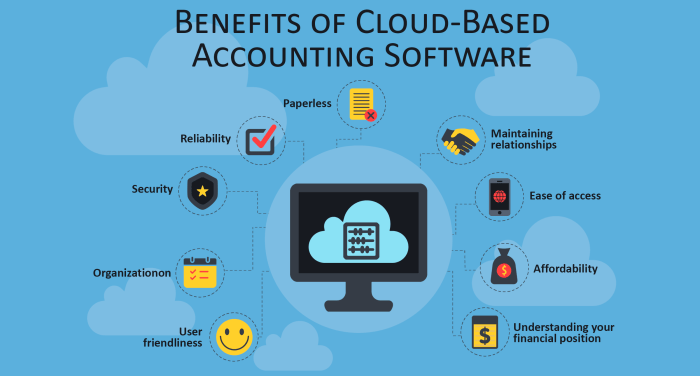

Benefits of Cloud-Based Accounting Software

Cloud-based accounting software offers a plethora of advantages over traditional desktop software, empowering businesses with enhanced efficiency, accuracy, and flexibility. Let’s delve into the myriad of benefits that make cloud-based accounting software an indispensable tool for modern businesses.

Improved Efficiency and Productivity

Cloud-based accounting software streamlines accounting processes, eliminating the need for manual data entry and reconciliation. With automated features and real-time updates, businesses can save significant time and effort, allowing them to focus on more strategic tasks that drive growth.

Accounting software on cloud can streamline your financial processes, making it easier to track expenses, generate invoices, and manage cash flow. As technology continues to advance, even the Launch of the Latest iPhone can be seamlessly integrated with accounting software, providing real-time access to financial data on the go.

This integration enhances efficiency and enables businesses to make informed decisions anytime, anywhere.

- Automated invoice generation and tracking reduce manual labor and minimize errors.

- Centralized data storage eliminates the need for multiple spreadsheets and disparate systems, enhancing accessibility and reducing data redundancy.

- Real-time collaboration allows multiple users to work on the same accounting tasks simultaneously, improving communication and reducing bottlenecks.

Enhanced Accuracy and Compliance

Cloud-based accounting software leverages robust security measures and data encryption protocols to safeguard financial data. Regular backups and automatic updates ensure data integrity and minimize the risk of data loss or corruption.

Cloud-based accounting software offers a convenient and accessible way to manage your finances. These platforms provide a comprehensive suite of tools to streamline your accounting processes, from invoicing and expense tracking to financial reporting. To get the most out of your cloud accounting software, it’s essential to understand the accounting software basics.

This includes familiarizing yourself with concepts such as debits and credits, balance sheets, and income statements. With a solid foundation in accounting principles, you can leverage the full capabilities of your cloud accounting software to optimize your financial management.

- Automated tax calculations and compliance features help businesses stay up-to-date with changing regulations, reducing the risk of penalties and fines.

- Bank-level security measures protect sensitive financial data from unauthorized access and cyber threats.

- Regular backups and disaster recovery plans ensure business continuity even in the event of hardware failures or natural disasters.

Increased Accessibility and Flexibility

Cloud-based accounting software provides anytime, anywhere access to financial data. Businesses can monitor their finances, generate reports, and collaborate with accountants remotely, enhancing flexibility and responsiveness.

- Mobile apps allow users to access accounting data and perform essential tasks on the go.

- Integration with other business applications, such as CRM and e-commerce platforms, streamlines workflows and improves data sharing.

- Scalability allows businesses to adjust their accounting software as their needs evolve, supporting growth and expansion.

Case Studies and Testimonials

Numerous businesses have experienced significant benefits by implementing cloud-based accounting software. Here are a few examples:

- A small business reduced its accounting time by 50% after switching to cloud-based software, allowing them to focus on customer acquisition and growth.

- A non-profit organization improved its financial reporting accuracy by 95%, enhancing transparency and accountability for donors and stakeholders.

- A large corporation streamlined its intercompany accounting processes by 70%, reducing errors and improving collaboration among subsidiaries.

Read more: Microsoft Accounting Software: The Ultimate Guide to Managing Your Finances

Features and Functionalities of Cloud-Based Accounting Software

Cloud-based accounting software offers a wide range of features and functionalities designed to streamline financial management processes for businesses of all sizes. These features can be broadly categorized into the following areas:

The following are some of the key features and functionalities commonly found in cloud-based accounting software:

Financial Management, Accounting software on cloud

- Bank Reconciliation:Automates the process of matching transactions from bank statements with those recorded in the accounting system, saving time and reducing errors.

- General Ledger:Provides a comprehensive view of all financial transactions, allowing users to track and analyze account balances in real-time.

- Accounts Payable:Manages the process of paying bills and expenses, including invoice processing, payment scheduling, and vendor management.

- Accounts Receivable:Manages the process of collecting payments from customers, including invoice generation, payment tracking, and customer management.

- Cash Flow Management:Provides insights into the flow of cash in and out of the business, helping businesses forecast cash flow and make informed financial decisions.

Invoicing

- Invoice Creation and Customization:Allows businesses to create professional invoices with custom branding and templates, making it easy to send invoices to customers.

- Invoice Tracking:Provides real-time visibility into the status of invoices, including whether they have been sent, viewed, or paid.

- Online Payments:Integrates with payment gateways to allow customers to pay invoices online, streamlining the payment process and reducing delays.

- Recurring Invoicing:Automates the process of generating and sending invoices for recurring services or subscriptions, saving time and effort.

Reporting

- Financial Statements:Generates financial statements such as balance sheets, income statements, and cash flow statements, providing insights into the financial performance of the business.

- Customizable Reports:Allows users to create custom reports tailored to their specific needs, enabling them to extract and analyze data in a meaningful way.

- Budgeting and Forecasting:Helps businesses create budgets and forecasts, enabling them to plan for the future and make informed financial decisions.

Collaboration

- Multi-User Access:Allows multiple users to access the accounting system simultaneously, enabling collaboration and efficient workflow.

- Document Sharing:Provides a platform for sharing financial documents and reports with colleagues, auditors, or other stakeholders.

- Audit Trail:Maintains a complete record of all transactions and changes made to the accounting system, ensuring transparency and accountability.

Read more: Affordable Accounting Software: A Comprehensive Guide for Small Businesses

Considerations for Choosing Cloud-Based Accounting Software

Choosing the right cloud-based accounting software is crucial for businesses. Several key factors need to be considered to make an informed decision.

First and foremost, businesses should evaluate the security measures implemented by the software provider. The software should employ robust encryption protocols, regular security audits, and multi-factor authentication to protect sensitive financial data.

Integration Capabilities

The software’s integration capabilities are also vital. Businesses should ensure that the software can seamlessly integrate with their existing business systems, such as CRM, ERP, and e-commerce platforms. This integration streamlines data flow, reduces manual data entry, and improves overall efficiency.

Customer Support

Reliable customer support is essential for any cloud-based software. Businesses should look for providers that offer timely and responsive support via multiple channels, such as phone, email, and live chat. Additionally, the provider should have a dedicated support team with expertise in accounting and cloud computing.

To assist businesses in making an informed decision, the following checklist can be used:

- Security measures: Encryption, security audits, multi-factor authentication

- Integration capabilities: CRM, ERP, e-commerce platforms

- Customer support: Availability, response time, expertise

- Scalability: Ability to handle growing business needs

- Pricing: Cost-effective and transparent pricing models

- User interface: Intuitive and easy to navigate

- Reputation: Reviews, testimonials, and industry recognition

Read more: Accounting Software Basics: A Comprehensive Guide

Implementation and Integration of Cloud-Based Accounting Software: Accounting Software On Cloud

Implementing and integrating cloud-based accounting software is a crucial step towards streamlining your financial operations and leveraging the benefits it offers. This section will guide you through the key steps involved in the implementation process and provide best practices for a successful integration with other business systems.

Steps Involved in Implementing Cloud-Based Accounting Software

- Planning and Preparation:Define your business requirements, identify key stakeholders, and establish a timeline for implementation.

- Software Selection:Evaluate different cloud-based accounting software options based on your specific needs, budget, and industry.

- Data Migration:Transfer your existing financial data from your old accounting system to the new cloud-based software.

- Configuration and Customization:Set up the software according to your business processes and preferences, including chart of accounts, tax settings, and user permissions.

- Training and User Adoption:Provide comprehensive training to your team on how to use the new software effectively.

- Go-Live and Support:Launch the cloud-based accounting software and provide ongoing support to users.

Integrating Cloud-Based Accounting Software with Other Business Systems

Integrating cloud-based accounting software with other business systems, such as CRM or ERP systems, can enhance efficiency and provide a comprehensive view of your operations. Here are some key considerations:

- Identify Integration Points:Determine the specific data and processes that need to be shared between the accounting software and other systems.

- Choose Integration Method:Select the appropriate integration method, such as APIs, data connectors, or third-party integration platforms.

- Map Data Fields:Ensure that data fields from both systems are correctly mapped to avoid errors and inconsistencies.

- Test and Validate:Thoroughly test the integration to ensure seamless data flow and accuracy.

- Monitor and Maintain:Regularly monitor the integration and make necessary adjustments to maintain its effectiveness.

Best Practices for Successful Implementation and Integration

- Engage Stakeholders:Involve key stakeholders throughout the implementation and integration process to ensure buy-in and support.

- Establish Clear Communication:Set up regular communication channels to keep stakeholders informed and address any concerns.

- Utilize Vendor Support:Leverage the support resources provided by the cloud-based accounting software vendor to ensure a smooth implementation and integration.

- Document the Process:Create detailed documentation of the implementation and integration process for future reference and knowledge transfer.

- Continuously Evaluate and Improve:Regularly review the effectiveness of the cloud-based accounting software and its integration to identify areas for improvement and optimization.

Read more: Accounting Software Top 10: A Comprehensive Guide for Businesses

Ultimate Conclusion

In conclusion, cloud accounting software has revolutionized the way businesses manage their finances. Its accessibility, affordability, and robust feature set make it an indispensable tool for organizations of all sizes. By embracing cloud accounting, businesses can unlock new levels of efficiency, accuracy, and financial insights, enabling them to stay competitive and thrive in today’s dynamic business landscape.