Accounting software with payroll –

Accounting software with payroll functionality has emerged as a cornerstone for businesses of all sizes, offering a comprehensive solution to streamline financial management and payroll processing. By integrating these essential functions, businesses can unlock a world of efficiency, accuracy, and compliance.

*

Features and Benefits: Accounting Software With Payroll

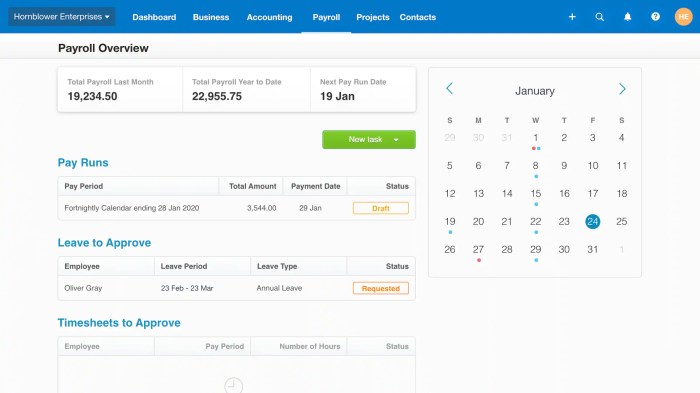

Accounting software with payroll functionality combines the essential features of accounting software with the specific capabilities needed for managing payroll processes. These software solutions streamline accounting tasks, simplify payroll processing, and provide valuable insights for businesses.

The core features of accounting software with payroll functionality typically include:

- General ledger management:Track financial transactions, generate financial reports, and maintain accurate accounting records.

- Accounts receivable and payable management:Manage invoices, payments, and customer and vendor relationships.

- Payroll processing:Calculate salaries and wages, withhold taxes, and generate paychecks.

- Time and attendance tracking:Monitor employee hours worked, overtime, and leave balances.

- Employee self-service:Allow employees to access pay stubs, update personal information, and request time off.

- Reporting and analytics:Generate reports on financial performance, payroll expenses, and employee data.

Benefits for Businesses of Various Sizes

Using accounting software with payroll functionality offers numerous benefits for businesses of all sizes, including:

- Increased efficiency:Automate payroll processing and reduce manual errors, freeing up time for other tasks.

- Improved accuracy:Eliminate the risk of human error in payroll calculations and ensure compliance with tax regulations.

- Enhanced security:Protect sensitive employee and financial data with robust security measures.

- Better decision-making:Access real-time financial and payroll data to make informed decisions about the business.

- Reduced costs:Eliminate the need for manual payroll processing and reduce the risk of costly errors.

- Improved employee satisfaction:Provide employees with easy access to pay stubs and other information, enhancing their experience.

Read more: Cloud Accounting Software: Revolutionizing Business Finance

Comparison of Popular Software Options

Choosing the right accounting software with payroll capabilities is essential for businesses of all sizes. With so many options available, it can be difficult to know which one is the best fit for your needs. To help you make an informed decision, we’ve compiled a table comparing some of the most popular software options on the market.

The table includes information on key features, pricing, and user reviews. We’ve also included a brief overview of each software option to help you get a better understanding of its strengths and weaknesses.

Key Features

- Payroll processing:This feature allows you to automate the process of calculating and paying employee wages.

- Tax filing:This feature helps you file payroll taxes with the appropriate government agencies.

- Time tracking:This feature allows you to track employee hours worked.

- Benefits administration:This feature helps you manage employee benefits, such as health insurance and retirement plans.

- Reporting:This feature allows you to generate reports on payroll data, such as payroll expenses and employee earnings.

Pricing

The pricing of accounting software with payroll capabilities can vary depending on the features included and the number of employees you have. Some software options offer a flat monthly fee, while others charge per employee.

User Reviews

User reviews can be a valuable source of information when choosing accounting software. Be sure to read reviews from other businesses that are similar to yours in size and industry.

Read more: Unveiling the Power of Oracle Accounting Software: A Comprehensive Guide

Implementation and Integration

Implementing accounting software with payroll functionality requires careful planning and execution. Here are some best practices to ensure a smooth transition:

Start by clearly defining your requirements and objectives. This will help you choose the right software and tailor its implementation to meet your specific needs.

Data Migration

Migrating data from your existing systems to the new accounting software is a critical step. It’s important to ensure accuracy and completeness by verifying the data before and after migration.

Integration with Existing Systems

Integrate the accounting software with your other systems, such as CRM, ERP, and HR, to streamline workflows and improve efficiency. Use APIs or connectors to establish seamless data exchange.

Accounting software with payroll functionality is essential for streamlining financial management. For churches, specialized accounting software for churches offers tailored features to meet their unique needs. However, when selecting accounting software with payroll, it’s crucial to consider factors such as ease of use, reporting capabilities, and integration with other church management systems.

Training and Support

Provide comprehensive training to your team on the new software. Ensure they understand its features, functionality, and how it integrates with their daily tasks. Ongoing support should also be available to address any issues or questions.

Read more: Microsoft Accounting Software: The Ultimate Guide to Managing Your Finances

Customization and Reporting

Accounting software with payroll capabilities offers a high level of customization to meet the unique requirements of different businesses. Users can tailor the software to suit their specific industry, business size, and accounting practices.

The software allows for customization of chart of accounts, financial reports, and payroll settings. Businesses can define their own account categories, create custom reports, and configure payroll calculations based on their specific needs.

For those seeking a comprehensive accounting software solution with payroll capabilities, look no further. Our software seamlessly manages your finances and employee compensation, providing you with real-time insights and streamlining your operations. If you’re looking for a fun diversion during your accounting breaks, check out the Best Iphone game for an immersive gaming experience.

Afterwards, return to our accounting software and continue optimizing your financial management.

Types of Reports

Accounting software with payroll generates a wide range of reports that provide valuable insights into financial performance and payroll operations. These reports include:

- Financial Reports:Balance sheet, income statement, cash flow statement, trial balance, and general ledger

- Payroll Reports:Payroll register, payroll summaries, tax reports, and employee earnings statements

- Compliance Reports:Payroll tax filings, W-2s, and 1099s

These reports can be customized to include specific data, time periods, and formatting options. Businesses can also schedule reports to be generated automatically and delivered via email or other channels.

Read more: Affordable Accounting Software: A Comprehensive Guide for Small Businesses

Security and Compliance

Accounting software with payroll functionality employs robust security measures to protect sensitive financial data. These measures include:

- Encryption of data both at rest and in transit

- Multi-factor authentication to prevent unauthorized access

- Role-based access controls to limit user permissions

- Regular security audits to identify and address vulnerabilities

Compliance with Regulations, Accounting software with payroll

The software also helps businesses comply with relevant regulations, such as:

- The Payment Card Industry Data Security Standard (PCI DSS)

- The Health Insurance Portability and Accountability Act (HIPAA)

- The Sarbanes-Oxley Act (SOX)

By automating payroll processes and maintaining accurate records, the software reduces the risk of errors and non-compliance, which can lead to fines and penalties.

Read more: Accounting Software Basics: A Comprehensive Guide

Last Word

In conclusion, accounting software with payroll capabilities empowers businesses to elevate their financial management and payroll processes to new heights. With its robust features, seamless integration, and unwavering security, it’s the key to unlocking operational efficiency, cost savings, and regulatory compliance.

Embrace the future of financial management and transform your business today.

-*