Introducing Xero accounting software, the game-changer for businesses seeking to simplify their accounting processes and elevate their financial management. With its intuitive interface, powerful automation capabilities, and seamless mobile accessibility, Xero empowers businesses of all sizes to streamline their operations and gain valuable insights into their financial performance.

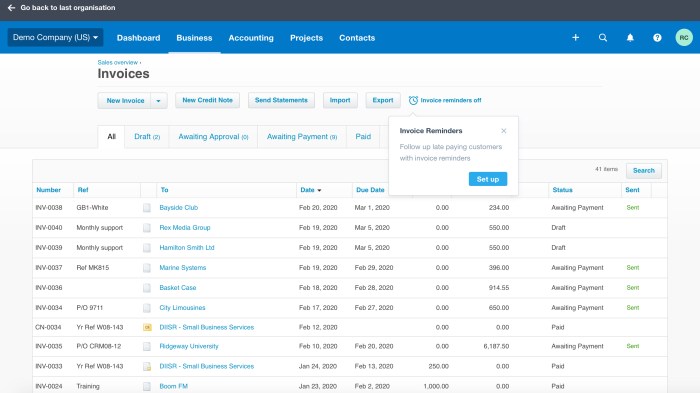

Xero’s user-friendly design makes it accessible to users of all experience levels, while its robust feature set caters to the diverse needs of growing businesses. From automating invoicing and bank reconciliation to providing real-time financial reporting, Xero seamlessly integrates with other business tools, such as CRM systems and e-commerce platforms, to create a cohesive and efficient workflow.

Features and Benefits of Xero Accounting Software

Xero is a cloud-based accounting software designed to make managing your finances easier. It offers a wide range of features that can help you streamline your accounting processes and improve your financial management.

One of the key benefits of Xero is its user-friendly interface. The software is designed to be easy to use, even for those who don’t have any accounting experience. This makes it a great choice for small businesses and startups.

Automation Capabilities

Xero also offers a number of automation capabilities that can save you time and money. For example, you can set up automatic bank feeds to import your transactions, and you can create automated invoices and reminders.

Mobile Accessibility

Xero is also accessible on the go. You can use the Xero mobile app to manage your finances from anywhere, at any time.

Improved Financial Management

Xero can help you improve your financial management by providing you with real-time insights into your financial data. You can use Xero to track your income and expenses, create budgets, and generate reports.

Read more: Cloud Accounting Software: Revolutionizing Business Finance

Comparison with Other Accounting Software

Xero is a popular accounting software option, but it’s not the only one on the market. Let’s compare Xero with other popular accounting software options, such as QuickBooks and Sage.

Functionality

Xero, QuickBooks, and Sage all offer a wide range of accounting features, including:

- Invoicing

- Expense tracking

- Financial reporting

- Payroll

- Inventory management

However, there are some key differences in functionality between the three software options.

Xero is known for its user-friendly interface and ease of use. It is also a cloud-based software, which means that you can access it from anywhere with an internet connection. QuickBooks is also a popular option, and it offers a wider range of features than Xero.

However, QuickBooks is not as user-friendly as Xero, and it is not a cloud-based software.

Sage is a more comprehensive accounting software option than Xero or QuickBooks. It offers a wider range of features, including more advanced financial reporting capabilities. However, Sage is also more expensive than Xero or QuickBooks.

Pricing

The pricing of Xero, QuickBooks, and Sage varies depending on the features that you need. However, in general, Xero is the most affordable option, followed by QuickBooks, and then Sage.

Xero offers a basic plan for $20 per month, a standard plan for $30 per month, and a premium plan for $40 per month. QuickBooks offers a simple start plan for $25 per month, an essentials plan for $40 per month, and a plus plan for $70 per month.

Xero accounting software is a cloud-based accounting solution designed to simplify financial management for businesses of all sizes. Nonprofits can also benefit from Xero’s robust features, including customizable reports, expense tracking, and accounting software nonprofit tools. With Xero, nonprofits can streamline their accounting processes, gain real-time insights into their financial performance, and make informed decisions to achieve their mission.

Sage offers a basic plan for $50 per month, a standard plan for $100 per month, and a premium plan for $150 per month.

Customer Support, Xero accounting software

Xero, QuickBooks, and Sage all offer customer support. However, the level of support varies depending on the plan that you choose.

Xero offers 24/7 customer support via phone, email, and chat. QuickBooks offers 24/7 customer support via phone and email. Sage offers 24/7 customer support via phone and email, but only for premium plan customers.

Xero accounting software is an excellent tool for managing your finances, but when you need a break from crunching numbers, check out Top 5 Fun Games for Your Phone: A Comprehensive Guide. This article provides detailed reviews of the most entertaining and addictive mobile games available.

After enjoying some gaming fun, return to Xero accounting software refreshed and ready to conquer your financial tasks.

Read more: Unveiling the Power of Oracle Accounting Software: A Comprehensive Guide

Integration with Other Business Tools: Xero Accounting Software

Xero seamlessly integrates with a wide range of business tools, enhancing efficiency and productivity across your organization. These integrations streamline workflows, automate tasks, and provide real-time data access, empowering you to make informed decisions and drive business growth.

By connecting Xero with your CRM system, you can effortlessly manage customer relationships, track sales pipelines, and generate invoices directly from your CRM platform. This integration eliminates manual data entry, reduces errors, and provides a comprehensive view of your customer interactions.

E-commerce Integrations

Xero’s integration with e-commerce platforms like Shopify and WooCommerce allows you to automate your online sales process. Orders are automatically imported into Xero, creating invoices and tracking payments, saving you time and reducing the risk of errors. Additionally, you can manage inventory levels, track shipping information, and reconcile transactions directly from your e-commerce platform.

Payroll Integrations

Integrating Xero with payroll software streamlines employee management and payroll processing. Employee data is automatically synced, eliminating the need for manual entry. You can process payroll, calculate taxes, and generate pay slips directly from Xero, ensuring accuracy and compliance. This integration also provides insights into employee expenses, time tracking, and leave management, enabling better workforce planning and cost control.

Read more: Microsoft Accounting Software: The Ultimate Guide to Managing Your Finances

Cloud-Based Advantages

Xero’s cloud-based nature offers a host of advantages, transforming accounting into a seamless and efficient process.

The accessibility of cloud-based accounting software like Xero empowers businesses to manage their finances from anywhere, at any time. With an internet connection, users can access their financial data, generate reports, and collaborate with their accountants remotely. This eliminates the need for physical storage and allows for real-time updates, ensuring that businesses have the most up-to-date financial information at their fingertips.

Data Security

Cloud-based accounting software like Xero prioritizes data security, implementing robust measures to safeguard sensitive financial information. Data is encrypted during transmission and storage, ensuring that it remains protected from unauthorized access. Regular backups and disaster recovery plans further mitigate the risk of data loss, providing businesses with peace of mind.

Automatic Updates

Xero’s cloud-based architecture enables automatic software updates, ensuring that businesses always have access to the latest features and security enhancements. These updates are seamless and do not require manual intervention, eliminating the hassle of downloading and installing updates, reducing downtime, and improving overall efficiency.

Read more: Affordable Accounting Software: A Comprehensive Guide for Small Businesses

Final Summary

In conclusion, Xero accounting software stands as a powerful ally for businesses seeking to streamline their accounting processes, improve financial visibility, and drive growth. Its cloud-based architecture, comprehensive feature set, and affordable pricing plans make it an ideal solution for businesses of all sizes.

By leveraging Xero’s capabilities, businesses can unlock a new level of financial efficiency, empowering them to make informed decisions and achieve their financial goals.