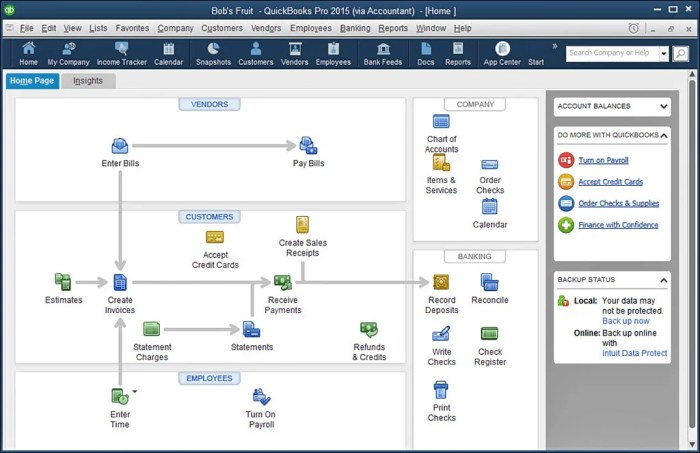

Accounting software desktop, a cornerstone of modern accounting practices, empowers businesses with unparalleled control over their financial operations. Delve into this comprehensive guide to unlock the essential features, benefits, and strategies for selecting and implementing the perfect desktop accounting software for your organization.

From streamlining accounting processes to gaining real-time financial insights, desktop accounting software transforms the way businesses manage their finances, enabling them to make informed decisions and achieve greater success.

Choosing the Right Desktop Accounting Software

Choosing the right desktop accounting software is crucial for businesses of all sizes. With numerous options available, it can be overwhelming to select the best fit. To guide you through the process, here’s a comprehensive step-by-step guide:

Factors to Consider, Accounting software desktop

- Business Size:Consider the number of transactions, employees, and complexity of your business operations.

- Industry:Specific industries may require specialized features, such as inventory management for retail or project tracking for professional services.

- Budget:Determine the financial resources available for software purchase and ongoing maintenance.

Read more: Cloud Accounting Software: Revolutionizing Business Finance

Implementation and Integration

Implementing desktop accounting software involves a series of steps to ensure a smooth and effective transition. The process typically includes:

- Planning:Defining the business requirements, selecting the appropriate software, and establishing a project timeline.

- Data Migration:Transferring existing accounting data from the old system to the new software.

- Configuration:Customizing the software to meet specific business needs, such as setting up chart of accounts, tax rates, and user permissions.

- Training:Providing training to users on how to use the new software effectively.

- Go-live:Activating the new software and transitioning from the old system.

Integrating desktop accounting software with other business systems, such as CRM or ERP, is essential for streamlining operations and improving data accuracy. The integration process typically involves:

- Identifying Integration Points:Determining the areas where data needs to be shared between the accounting software and other systems.

- Establishing Data Mapping:Defining how data fields in the accounting software correspond to fields in the other systems.

- Implementing Integration Tools:Using APIs, middleware, or other integration tools to facilitate data exchange.

- Testing and Validation:Thoroughly testing the integration to ensure data integrity and seamless functionality.

Read more: Unveiling the Power of Oracle Accounting Software: A Comprehensive Guide

Final Thoughts: Accounting Software Desktop

In the ever-evolving landscape of business, desktop accounting software stands as an indispensable tool, empowering organizations with the precision, efficiency, and insights they need to thrive. By embracing the transformative power of this technology, businesses can unlock their full potential and achieve lasting financial success.

When selecting accounting software for your desktop, consider the xero accounting software , a popular choice for its user-friendly interface and robust features. Designed for small businesses and accountants, xero accounting software offers a range of accounting tools, including invoicing, expense tracking, and financial reporting.

It seamlessly integrates with other business applications, making it a comprehensive solution for managing your finances.

For those seeking an efficient way to manage their finances, accounting software desktop offers a range of robust features. However, if you’re looking for a quick break from the numbers, check out Top 5 Free Android Games: A Comprehensive Review for a list of engaging mobile games.

When you’re ready to return to your accounting tasks, you’ll find that desktop software provides a seamless and organized workflow for all your financial needs.