Accounting software home: a comprehensive guide to help you choose the right software for your home-based business.

In this article, we’ll cover the key features and benefits of accounting software, the different types available, and how to choose the right one for your needs. We’ll also provide tips for using accounting software effectively and troubleshooting common issues.

Types of Accounting Software Available for Home Users: Accounting Software Home

Home users have a variety of accounting software options to choose from, each with its own set of features and benefits. Here’s a categorization of different types of accounting software based on functionality and complexity:

Cloud-Based Accounting Software

Cloud-based accounting software is hosted on a remote server, allowing users to access their financial data from any device with an internet connection. This type of software is typically more affordable and easier to use than desktop software, making it a good option for small businesses and home users.

Advantages:

- Affordable

- Easy to use

- Accessible from anywhere with an internet connection

- Automatic updates

Disadvantages:

- Relies on an internet connection

- May have limited features compared to desktop software

Desktop Accounting Software

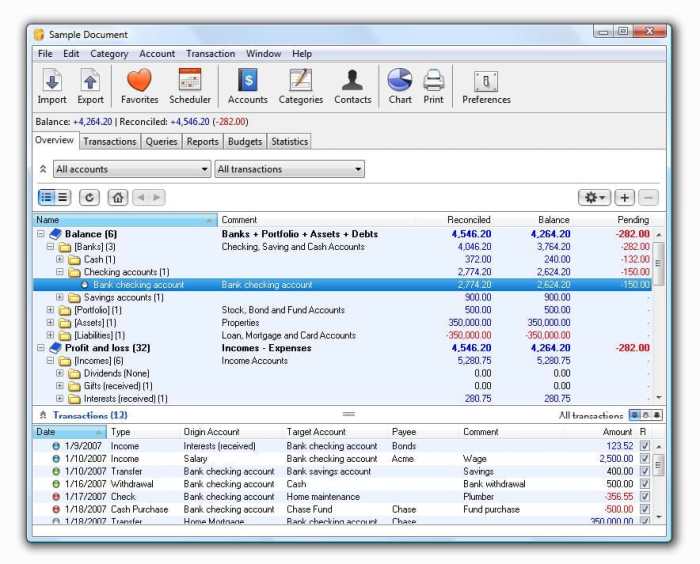

Desktop accounting software is installed on a user’s computer. This type of software typically offers more features and functionality than cloud-based software, but it can also be more expensive and difficult to use.

Advantages:

- More features and functionality

- Does not require an internet connection

- Can be customized to meet specific needs

Disadvantages:

- More expensive

- More difficult to use

- Not accessible from multiple devices

Mobile-Friendly Accounting Software

Mobile-friendly accounting software is designed to be used on smartphones and tablets. This type of software is typically less feature-rich than desktop or cloud-based software, but it can be a good option for users who need to access their financial data on the go.

Advantages:

- Convenient

- Can be used anywhere

- Easy to use

Disadvantages:

- Less feature-rich

- May not be as secure as desktop or cloud-based software

Baca Juga: Cloud Accounting Software: Revolutionizing Business Finance

Choosing the Right Accounting Software for Home Use

Choosing the right accounting software for home use can be a daunting task, but it’s essential to find one that meets your specific needs. Here’s a step-by-step guide to help you make the best decision:

Step 1: Determine Your Business Needs

- What type of business do you have?

- What are your accounting needs?

- How many transactions do you process each month?

- Do you need to track inventory?

- Do you need to generate reports?

Step 2: Consider Your Industry

Some accounting software is designed for specific industries, such as retail, healthcare, or manufacturing. If you have a specialized business, it’s important to choose software that is tailored to your industry.

If you’re looking for accounting software that can streamline your financial management, look no further than accounting software home. With its user-friendly interface and comprehensive features, you can easily track your income and expenses, manage your accounts payable and receivable, and generate reports.

Plus, for businesses that need to manage payroll, accounting software home seamlessly integrates with leading accounting software with payroll solutions, making it a one-stop solution for all your accounting needs.

Step 3: Set a Budget

When it comes to accounting software, home is where the heart is. With the right software, you can easily manage your finances, track your expenses, and stay on top of your cash flow. However, if you’re looking for a break from crunching numbers, why not take a break and check out the 5 Best Android Game ?

These games are sure to provide hours of entertainment and help you relax after a long day of work. When you’re ready to get back to business, your accounting software will be waiting for you, ready to help you get your finances in order.

Accounting software can range in price from free to thousands of dollars. It’s important to set a budget before you start shopping so that you don’t overspend.

Step 4: Evaluate Software Demos

Most accounting software companies offer free demos. This is a great way to get a feel for the software and see if it meets your needs. When evaluating a demo, pay attention to the following:

- The user interface

- The features and functionality

- The ease of use

- The customer support

Step 5: Read Reviews

Once you’ve evaluated a few software demos, read reviews from other users. This can give you valuable insights into the pros and cons of each software.

Baca Juga: Unveiling the Power of Oracle Accounting Software: A Comprehensive Guide

Best Practices for Using Accounting Software at Home

Effective use of accounting software at home requires careful setup, meticulous record-keeping, and strategic utilization. By following these best practices, you can maximize the software’s capabilities and maintain accurate financial records.

To begin, it’s crucial to set up the software correctly. This includes creating appropriate accounts, customizing reports, and setting up automated features. Once configured, regularly review and update the software to ensure it aligns with your evolving financial needs.

Maintaining Accurate Records, Accounting software home

Accurate record-keeping is paramount. Regularly reconcile bank statements, credit card transactions, and other financial documents to ensure the software’s data matches your actual financial position. Additionally, avoid manual data entry whenever possible, as this minimizes the risk of errors.

To prevent common pitfalls, such as duplicate entries or incorrect categorizations, establish clear guidelines for data entry and review. Regular backups of your financial data are also essential to safeguard against data loss in the event of a hardware failure or software malfunction.

Maximizing Software Capabilities

To fully leverage the software’s capabilities, explore its advanced features. Many software packages offer tools for budgeting, forecasting, and generating financial reports. Utilize these features to gain insights into your financial performance and make informed decisions.

Additionally, consider integrating your accounting software with other financial tools, such as online banking or investment tracking apps. This integration streamlines financial management and provides a comprehensive view of your financial situation.

Baca Juga: Microsoft Accounting Software: The Ultimate Guide to Managing Your Finances

Outcome Summary

By following the tips in this guide, you can choose the right accounting software for your home-based business and use it effectively to manage your finances.